| HELP |

|

|

|

|

| http://www.vertex42.com/Calculators/annuity-calculator.html |

© 2009-2016 Vertex42 LLC |

|

|

|

|

|

|

|

| About

This Template |

|

|

|

|

This annuity calculator

is based on general finance theory. It is designed to simulate a case where a

person makes regular withdrawals from an account that is earning interest. It

also allows you to enter an annual inflation rate to simulate the case where

the person increases the amount that they withdraw each period (to keep up

with rising expenses for example). |

|

|

|

|

|

|

|

|

|

Taxes: This spreadsheet does not account for taxes. Iinterest is

assumed to be earned tax free. To get around that, you could try entering a

tax-adjusted interest rate (e.g. if you're in a 25% tax bracket, subtract 25%

from the expected Annual Interest Rate). Payouts represent pre-tax

withdrawals. So, if you are receiving payments from a Roth IRA, you wouldn't

pay tax, but if you are receiving payments from a Traditional IRA, you

would. |

|

|

|

|

|

|

|

|

|

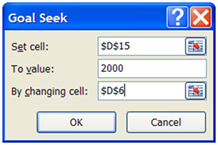

TIP: Use Excel's built-in Goal Seek utility (Data > What-If

Analysis > Goal Seek) to answer the following question: |

|

|

|

|

|

|

|

|

|

What does the Starting Principal need to be if I want

a payout of 2000 per Month? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Additional

Help |

|

|

|

|

The link at the top of this

worksheet will take you to the web page on vertex42.com that talks about this

template. |

|

|

|

|

|

|

|

|

| |

REFERENCES |

|

|

|

|

|

|

|

|

| SEE ALSO |

Vertex42.com: Loan

Amortization Schedule |

|

|

|

|

|

|

|

|

| SEE ALSO |

Vertex42.com: Personal Budget

Spreadsheet |

|

|

|

|

|

|

|

|

| TIPS |

Vertex42.com: Spreadsheet Tips Workbook |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|